Global Solar Market Growth Opportunities and the Lecheng Advantage in PV Production and Test Equipment

Market momentum and structural shifts

The global solar industry is moving from hyper‑growth into a more rational phase. Forecasts for 2025–2030 global renewable capacity have been revised down by 5%, yet annual PV additions are still expected to total about 3.68 terawatts, with PV accounting for nearly 80% of new renewables. In the near term, installations are seen rising from about 600 GW in 2025 to around 700 GW by 2029, as markets recalibrate to grid capacity, permitting, and policy cycles. Regionally, Europe remains resilient under auction mechanisms and cost declines, while the Middle East and North Africa emerge as new high‑growth poles, with Saudi Arabia and Pakistan accelerating utility‑scale projects. By 2030, solar is projected to become the largest source of renewable electricity globally, underscoring a multi‑year demand backbone even as growth rates moderate.

Emerging markets driving incremental demand

Demand is broadening beyond traditional strongholds. In 2024, China’s PV module exports reached 235.93 GW, with about 47% flowing to the Global South, a historic high. Regionally, exports to the Middle East surged +99%, Africa +43%, Asia +43%, and the Americas +10%, reflecting strong policy support, energy security needs, and cost competitiveness. The number of gigawatt‑scale PV markets expanded from 28 in 2022 to 31 in 2023 and an estimated 37 in 2024, highlighting a more distributed and resilient demand map. For technology and equipment suppliers, this translates into more diverse qualification cycles, localized service needs, and broader product portfolios.

Technology inflection and premium segments

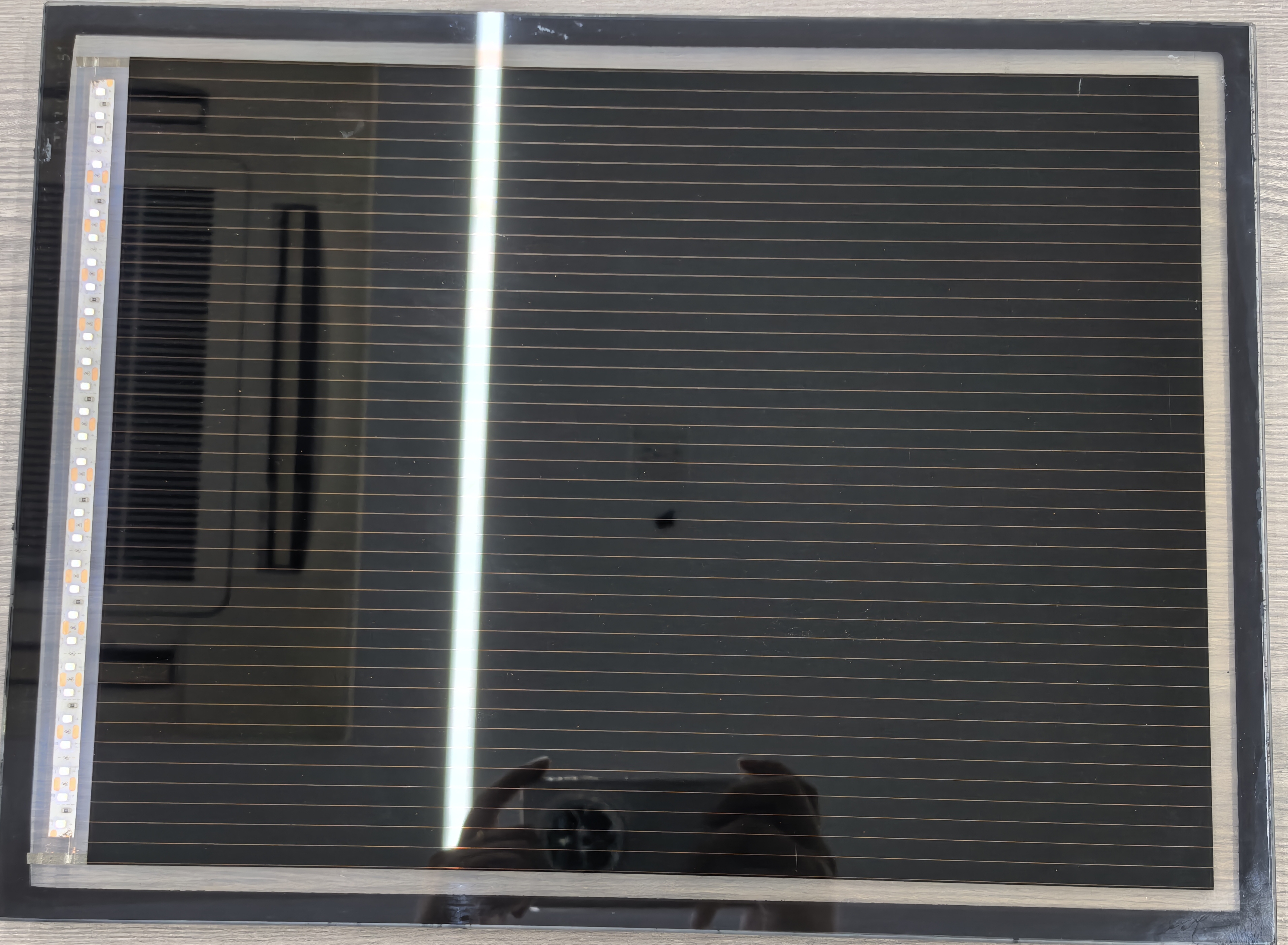

Efficiency and value differentiation are becoming decisive. N‑type TOPCon has become the mainstream, with >75% cell capacity share, while HJT and BC (Back Contact) architectures are scaling rapidly on the back of higher efficiencies and system value. In 2025, BC products are seeing an earnings inflection and a clear premium, supported by strong aesthetics and reliability in distributed applications. For manufacturers, this creates opportunities to capture value not just in volume, but in high‑efficiency, high‑quality segments—where advanced process control and end‑to‑end testing are critical.

Lecheng’s opportunity and value proposition

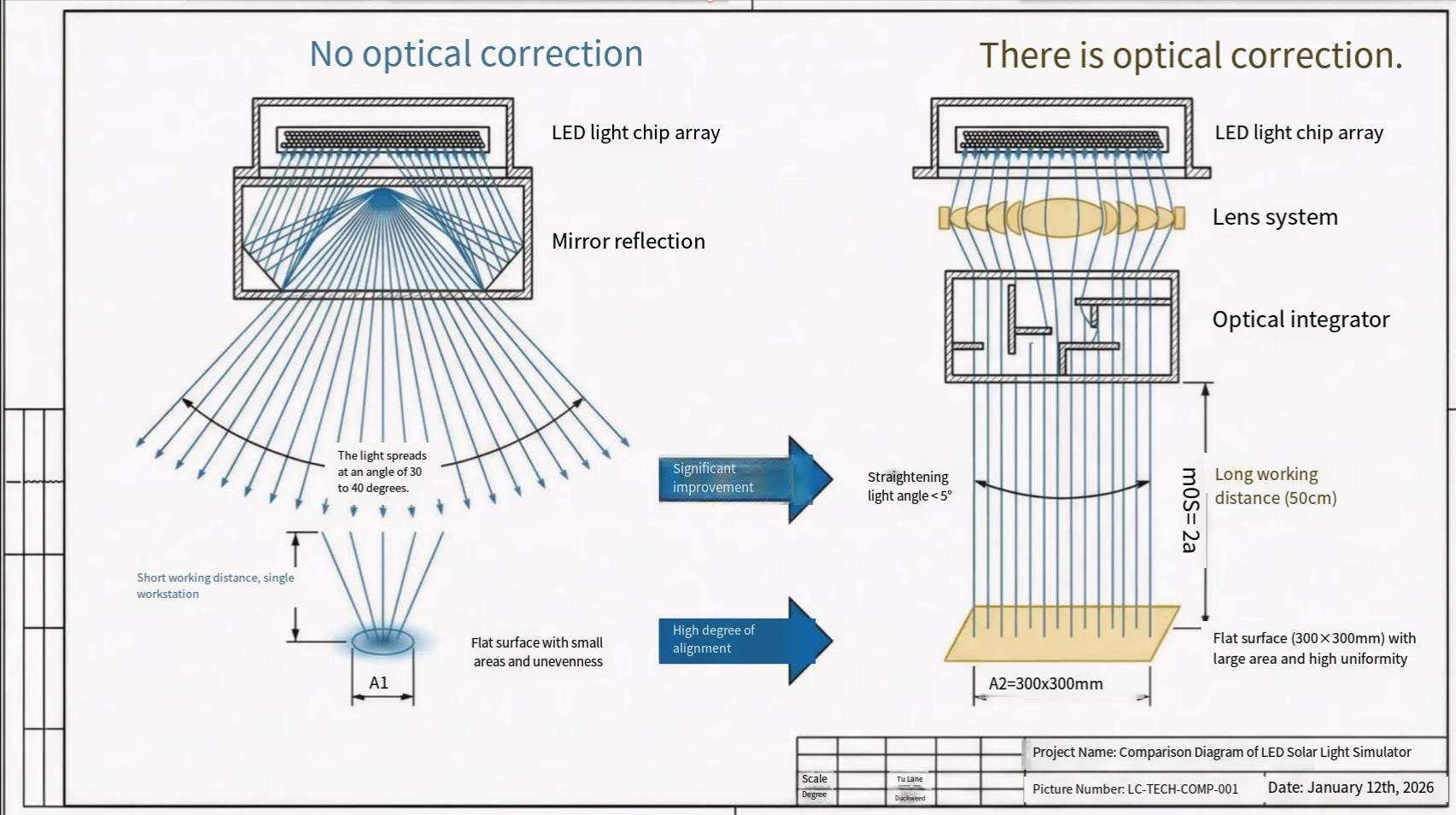

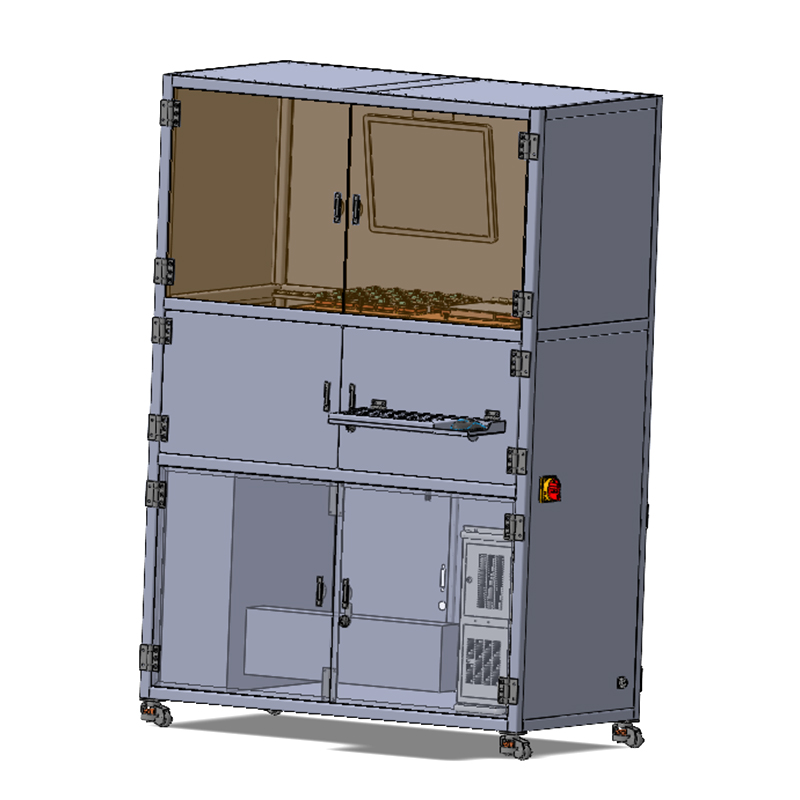

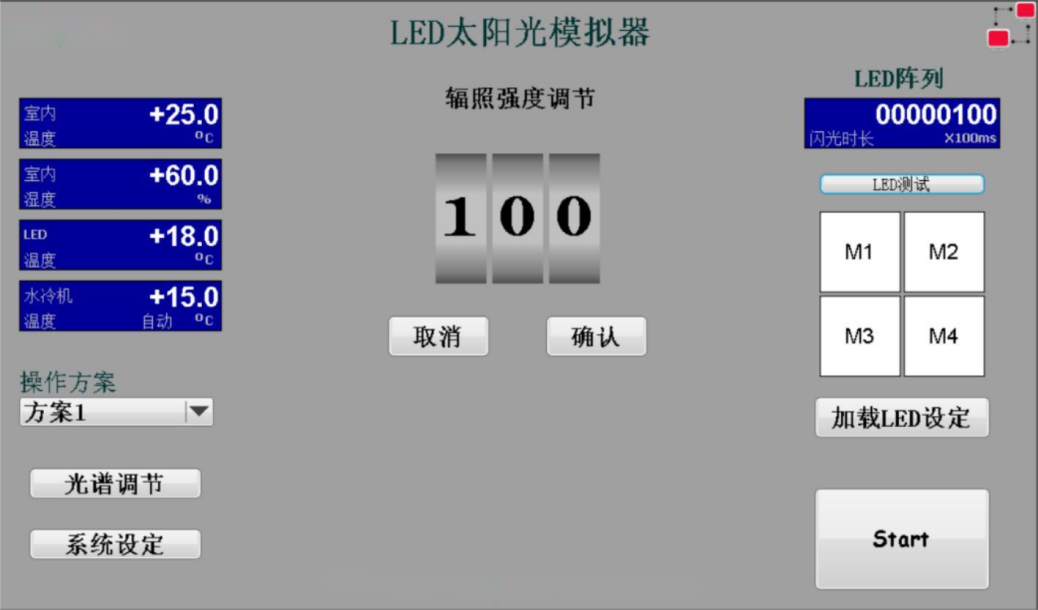

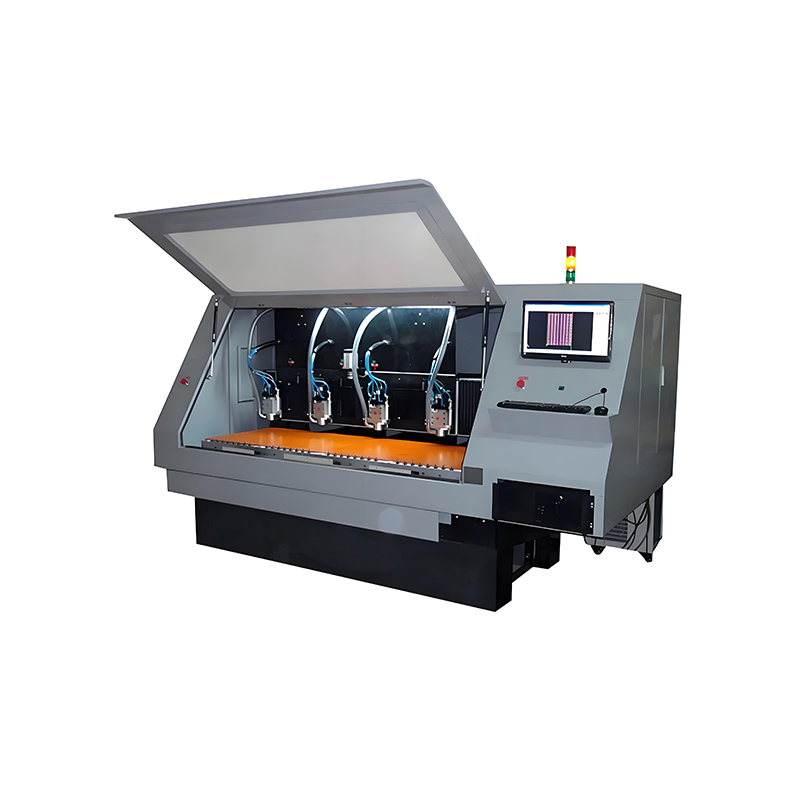

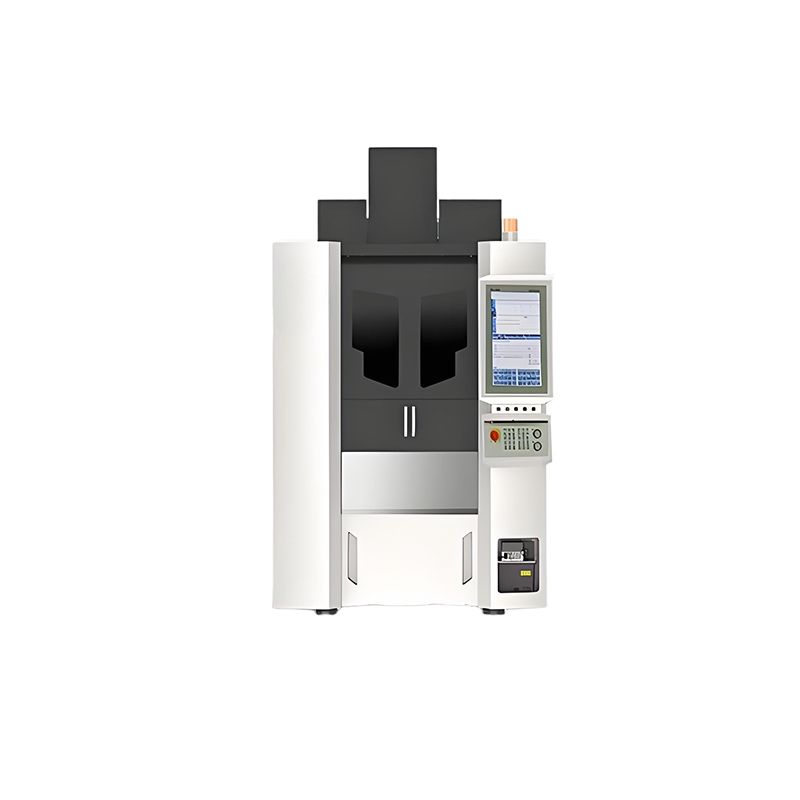

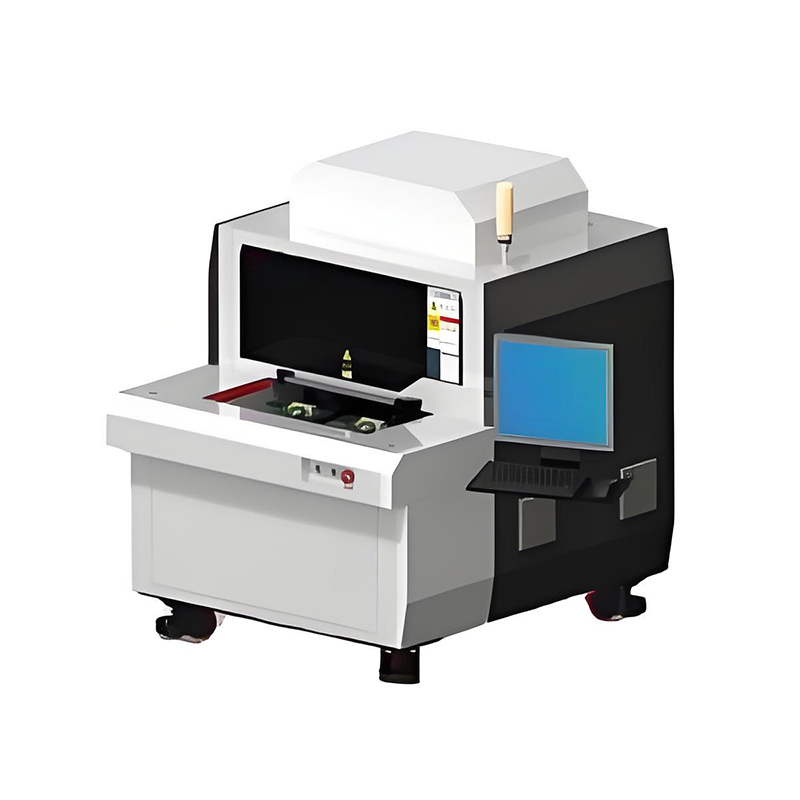

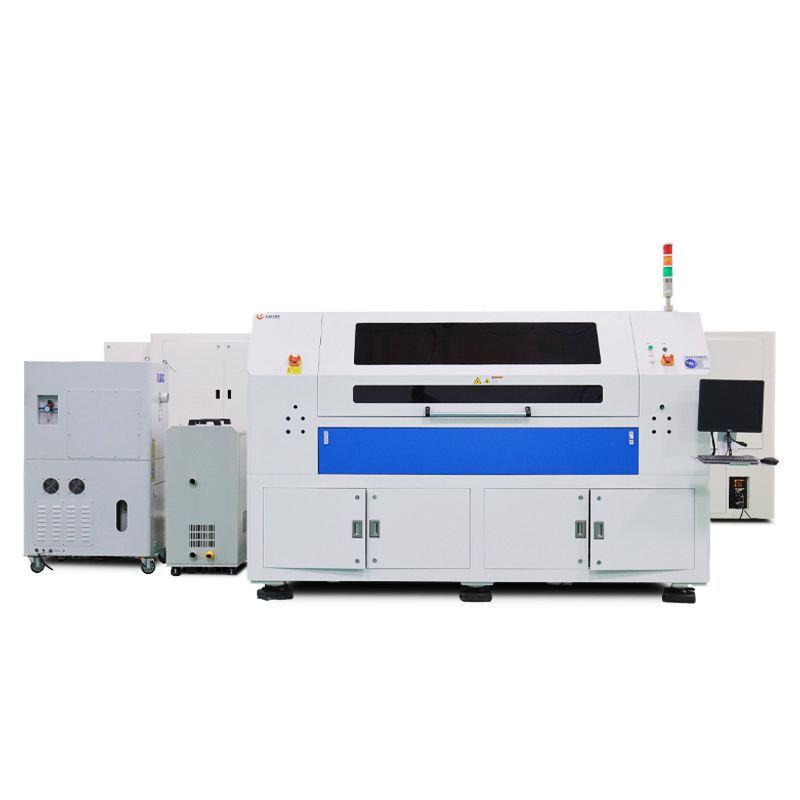

For a technology provider like Lecheng, this environment plays to core strengths in PV production and test equipment. The shift toward high‑efficiency cells and modules raises the bar for inline metrology, yield analytics, and reliability validation—from cell‑level EL imaging to module‑level electroluminescence, IV curve testing, and STC conversion under real‑world conditions. Lecheng can differentiate by delivering:

High‑throughput, high‑precision inline inspection (EL/IV) with AI‑assisted defect detection and grading to reduce false calls and rework.

Context‑aware testing that supports multiple cell architectures (TOPCon, HJT, BC) and module formats, with fast recipe switching and traceable data pipelines.

Field‑ready service ecosystems for commissioning, training, and rapid spare‑part response across emerging markets.

Data‑driven quality management that links fab‑floor measurements to module performance and warranty risk, enabling customers to prove bankability and PPAs compliance.

Actionable steps to capture growth

Prioritize BC‑ready testing platforms and process windows that match the latest cell designs and high‑current modules.

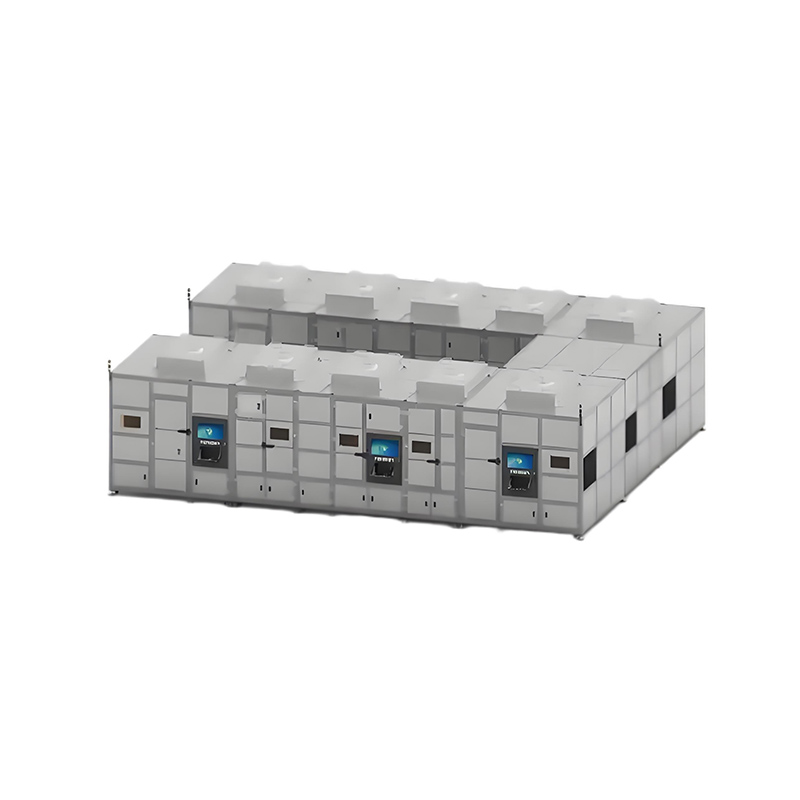

Build modular, upgradeable production lines with standardized data interfaces to accelerate NPI and reduce integration risk for multi‑country deployments.

Expand local service and training capacity in the Middle East, South Asia, and Africa to shorten lead times and improve customer uptime.

Offer sustainability‑linked service contracts (energy use, yield, CO₂ footprint) to align with ESG and buyer procurement criteria.

Strengthen after‑sales analytics to predict failures, schedule preventative maintenance, and turn quality data into commercial leverage.

Conclusion

The global PV market is entering a quality‑first, system‑value era: growth is broadening across regions, technologies are differentiating by efficiency and aesthetics, and the industry is consolidating around higher standards and smarter manufacturing. For Lecheng, aligning product roadmaps with these structural trends—especially in high‑efficiency cell and module testing—can unlock sustained share gains and long‑term customer value in both established and emerging markets.

SEO keywords

Global solar market growth 2025–2030

Emerging markets PV demand Middle East North Africa

BC back contact solar module technology

N-type TOPCon HJT cell testing equipment

PV production and test equipment Lecheng

Inline EL IV curve testing solutions

High-efficiency module quality assurance

Utility-scale solar EPC testing requirements

Solar module export trends 2024–2025

Gigawatt-scale PV markets global south